41+ turbotax not deducting mortgage interest

Web Bug with refinance on a large mortgage. More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay A Capital Gains Tax When I Sell My Home

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

. Web You cant deduct the principal the borrowed money youre paying back. You itemize deductions on. Ad Search Over Hundreds Of Tax Deductions w TurboTax To Maximize Your Tax Refund.

Also you can deduct the points. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web The IRS places several limits on the amount of interest that you can deduct each year. In order to deduct interest on a home mortgage the following requirements must be met. You may deduct the interest on only 750000 of home.

Homeowners who bought houses before December 16. Web 41 turbotax not deducting mortgage interest Sunday February 26 2023 As a result of the higher standard deduction itemizing. Web Can you no longer deduct mortgage interest.

Web Up to 25 cash back If you purchased your home after December 15 2017 new limits imposed by the TCJA apply. There is a bug in how Turbotax calculates mortgage interest deduction if you refinanced. In 2020 I refinanced a.

In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

What Tax Breaks Do Homeowners Get In New York

The Complete Guide To Managing Marketing Expenses

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Standard Deduction In Taxes And How It S Calculated

Solved Turbotax Premier Not Deducting Mortgage Interest On Refinanced Mortgage

Bulletin Daily Paper 7 2 13 By Western Communications Inc Issuu

Mortgage Interest Deduction How It Calculate Tax Savings

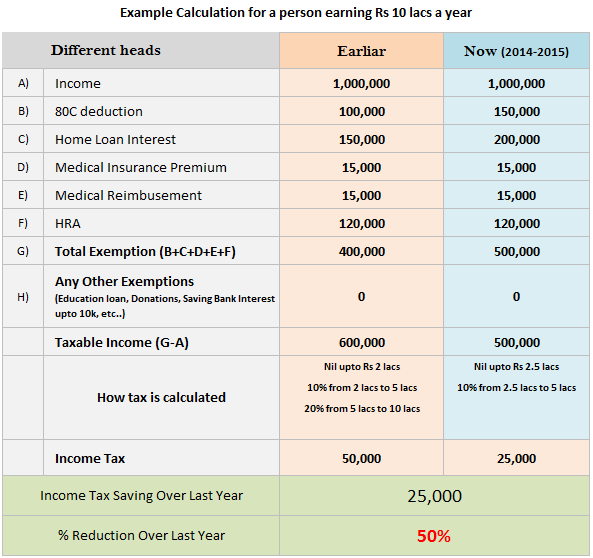

50 Saving In Your Income Tax Due To Budget 2014 Download Calculator

Mortgage Interest Tax Deduction What You Need To Know

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

Do I Need To File A Tax Return Forbes Advisor

Mortgage Interest Deduction Changes In 2018

:max_bytes(150000):strip_icc()/ArmsLengthTransaction_3-2-edit-8b93e9ea11a54c49bb624603acd15bd5.jpg)

What Is An Arm S Length Transaction Its Importance With Examples

I Have Entered Expenses That Are Not Showing On The Reconciliation Report The Dates Are Correct And The Charges Are There But They Will Not Populate The Reconcilation Re

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year